Keep up with tech in 5 minutes

Get the free daily email with summaries of the most interesting stories in startups 🚀, tech 📱, and programming 💻!

Join 1,250,000 readers for

Boston Dynamics' new humanoid moves like no robot you've ever seen (6 minute read)

Boston Dynamics' next-generation Atlas robot features all-electric 360-degree joints that enable it to move in inhuman ways. The company has retired the previous Atlas' hydraulic system to create a new robot a fraction of the size and weight that also looks like a product. It has some impressive capabilities, like being able to stand up from a lying face-down position. A short video of Atlas demonstrating the new way it moves is available in the article.

Apr 18 | Webdev

Hardest Problem in Computer Science: Centering Things (8 minute read)

Centering UI elements is surprisingly hard due to factors like font metrics (which can be inconsistent), line height complexities, and the difficulty of aligning text with icons. This article shows multiple examples of non-centered text on websites from companies like Apple, Slack, Microsoft, GitHub, and Google. Some tips to align elements properly: stop using fonts for icons, understand your font metrics, and pay more attention to alignment in the first place.

Apr 18 | AI

The Challenges of Getting ML Models to Production (37 minute read)

A deep dive interview from industry experts on the challenges and solutions of getting AI models into production and where MLOps differs from traditional engineering. They discuss why so few ML projects make it to production and how to focus as an organization to actually launch.

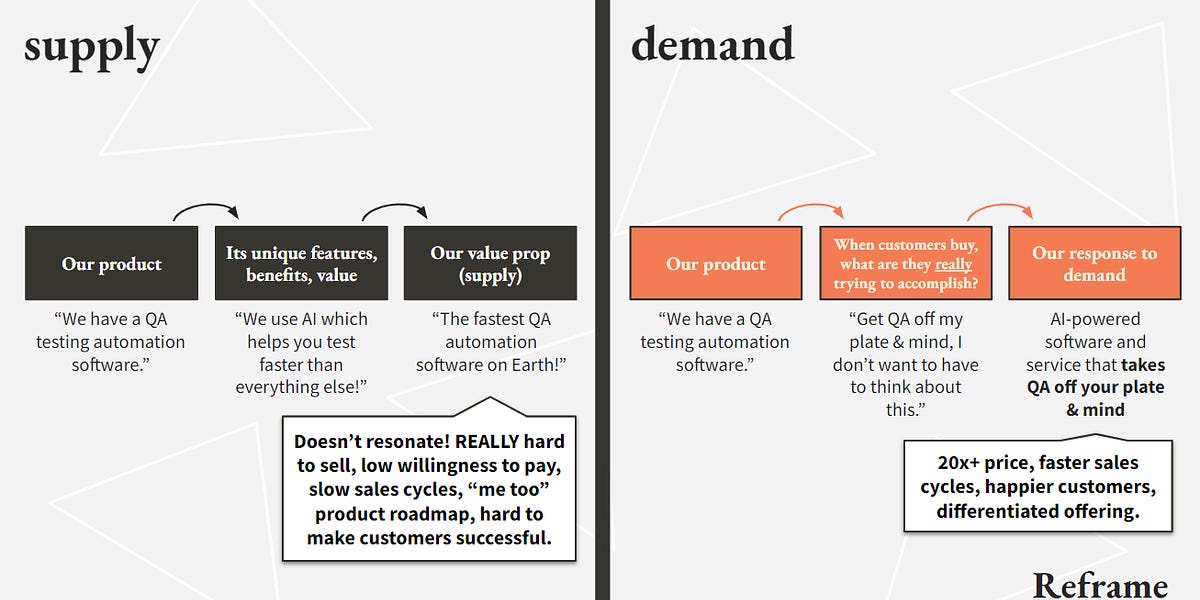

Apr 18 | Marketing

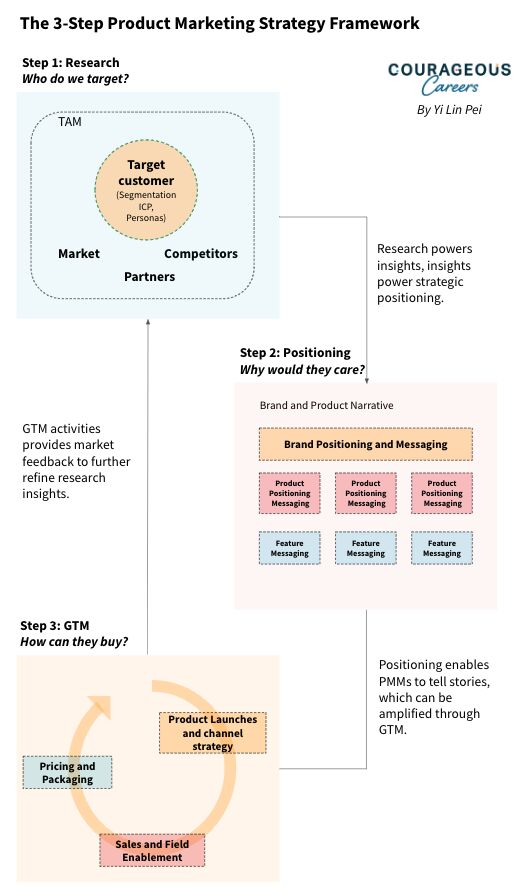

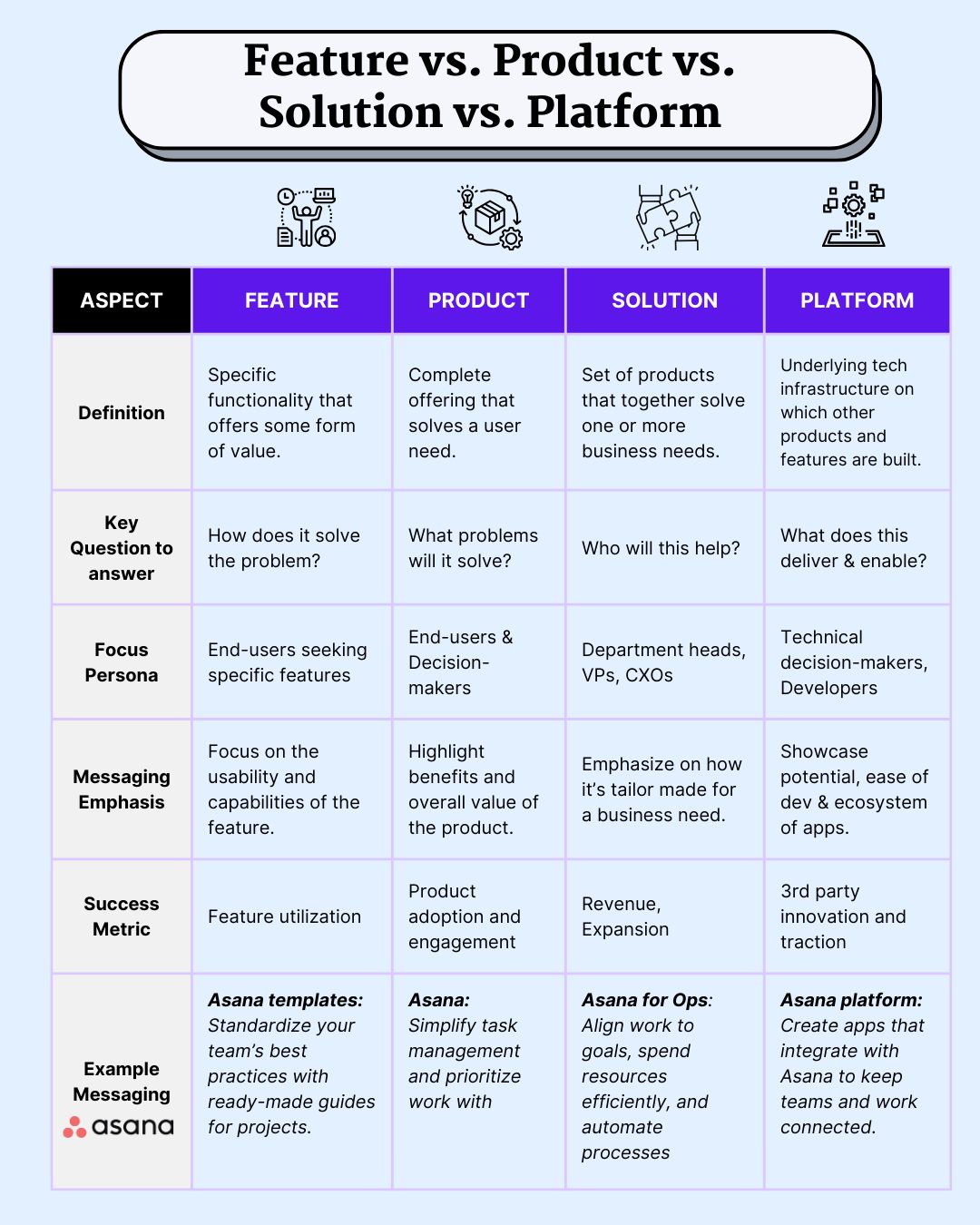

100+ Product Marketing and Product Management templates (Notion File)

This Notion file contains over 100 PMM and PM templates, work samples, frameworks, maps, playbooks, and checklists categorized by user research, personas and segmentation, positioning, messaging, pricing frameworks, GTM checklists, and more. Each template specifies whether registration is required for access or not.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25404681/pal_promo.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25394750/All_Colors_Back.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25330654/STK414_AI_CHATBOT_E.jpg)

![Why CryptoPunks are [Still] Valuable (7 minute read)](https://images.mirror-media.xyz/nft/3LVizKZxcr37ShLR-TfDB.png)